USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

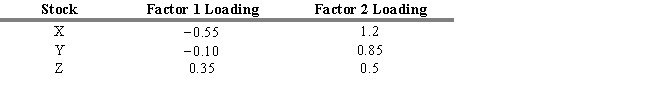

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected returns for stock X, stock Y, and stock Z are

A) 3 percent, 8 percent, 10 percent

B) 7.1 percent, 10.5 percent, 8.8 percent

C) 7.1 percent, 8.8 percent, 10.5 percent

D) 10 percent, 5.5 percent, 14 percent

E) 14 percent, 5.5 percent, 12 percent

Correct Answer:

Verified

Q129: Under the following conditions, what are the

Q130: Consider the following list of risk factors:

Q131: A study by Chen, Roll, and Ross

Q132: In a microeconomic (or characteristic)-based risk factor

Q133: Consider a two-factor APT model in which

Q135: Under the following conditions, what are the

Q136: The equation for the single-index market model

Q137: A 1994 study by Burmeister, Roll, and

Q138: Consider the following list of risk factors:

Q139: One approach for using multifactor models is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents