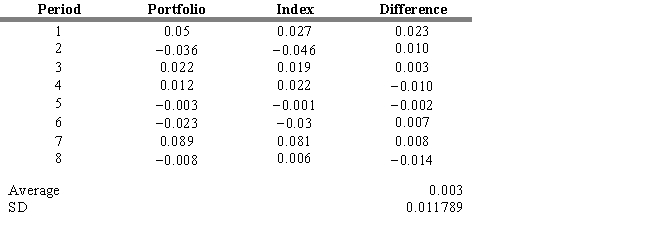

The table below provides returns on a portfolio along with returns for the corresponding benchmark index for the past eight quarters. The table also provides the difference between portfolio returns and the benchmark index, the average of these differences over the past eight quarters, and the standard deviation of these differences.  The annualized tracking error for this period is

The annualized tracking error for this period is

A) 2.36 percent.

B) 4.08 percent

C) 2.89 percent.

D) 3.33 percent.

E) 1.18 percent.

Correct Answer:

Verified

Q17: An advantage of sampling is that portfolio

Q18: An attempt on the manager's part to

Q19: The value investor focuses on share price

Q20: The three basic techniques for constructing a

Q21: The goal of the passive portfolio manager

Q23: Which of the following is NOT considered

Q24: All of the following are advantages of

Q25: Style investing involves constructing portfolios in such

Q26: Which of the following is considered a

Q27: It does not make economic sense for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents