USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

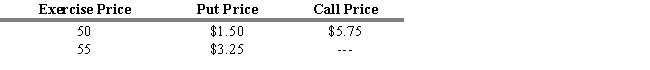

The current stock price of ABC Corporation is $53.50. ABC Corporation has the following put and call option prices that expire six months from today. The risk-free rate of return is 5 percent, and the expected return on the market is 11 percent.

-Refer to Exhibit 14.6. How could an investor create arbitrage profits?

A) sell the stock short, write a put, buy a call, and invest the proceeds at the risk-free rate

B) buy the stock, write a put, buy a call, and invest the proceeds at the risk-free rate

C) sell the stock short, buy a put, write a call, and invest the proceeds at the risk-free rate

D) buy the stock, write a put, buy a call, and borrow the strike price at the risk-free rate

E) sell the stock short, write a put, buy a call, and borrow the strike price at the risk-free rate.

Correct Answer:

Verified

Q92: A stock currently trades for $63. Call

Q93: In the valuation of an option contract,

Q94: A one-year call option has a strike

Q95: A one-year call option has a strike

Q96: Which of the following is consistent with

Q98: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q99: Holding a put option and the underlying

Q100: A stock currently trades for $115. January

Q101: A hedge strategy known as a collar

Q102: The derivative based strategy known as portfolio

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents