USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

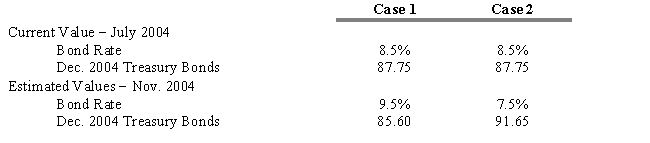

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. What is the dollar gain or loss assuming that future conditions described in Case 1 actually occur? (Ignore commissions and margin costs .)

A) $47,316,683.00 gain

B) $36,566,683.00 loss

C) $10,750,000.00 gain

D) $10,750,000.00 loss

E) $0

Correct Answer:

Verified

Q49: The basis (Bt,T) at time t between

Q50: The inclusion of the following in the

Q51: Financial futures include all of the following

Q52: The most popular financial futures in terms

Q53: In your portfolio you have $1 million

Q55: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q56: When F0,T > E(ST), it is known

Q57: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q58: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q59: Financial futures have become an increasingly attractive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents