USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

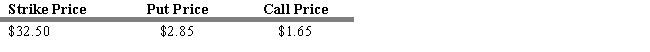

Consider the following information on put and call options for Citigroup

-Refer to Exhibit 16.4. Calculate the net value of a covered call position at a stock price at expiration of $20 and a stock price at expiration of $45.

A) $6.35, $18.85

B) $29.65, $42.15

C) $21.65, $34.15

D) $8, $8

E) -$8, -$8

Correct Answer:

Verified

Q64: A money spread involves buying and selling

Q65: Assume that you have just sold a

Q66: Assume that you have just sold a

Q67: Options can be used to

A) modify an

Q69: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q70: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q71: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q72: In a money spread, an investor would

A)

Q73: If the hedge ratio is 0.50, this

Q77: If you were to purchase an October

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents