USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

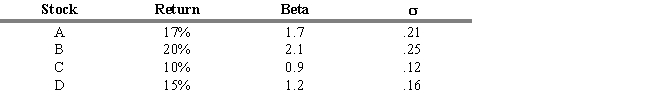

An analyst is considering investing in funds A, B, C, and D. The market portfolio, M, is expected to be 11 percent next period, and the risk-free rate of return is 3 percent. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds.

-Refer to Exhibit 18.8. Rank the four funds and market portfolio in order from highest to lowest based on their Sharpe measures.

A) A, B, C, D, M

B) B, C, M, D, A

C) C, A, M, D, B

D) D, A, B, M, C

E) D, B, A, C, M

Correct Answer:

Verified

Q87: A portfolio performance measurement technique that decomposes

Q88: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q89: In the Characteristic Selectivity (CS) performance measure,

A)

Q90: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q91: Selectivity measures how well a portfolio performed

Q93: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q94: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q95: A manager's superior returns could have occurred

Q96: In the evaluation of bond portfolio performance,

Q97: USE THE INFORMATION BELOW FOR THE FOLLOWING

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents