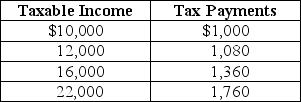

Table 18-5

Table 18-5 shows the amount of taxes paid on various levels of income.

Table 18-5 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-5.The tax system is

A) progressive throughout all levels of income.

B) proportional throughout all levels of income.

C) regressive throughout all levels of income.

D) progressive between $10,000 and $12,000 of income and regressive between $12,000 and $22,000.

Correct Answer:

Verified

Q55: Table 18-3 Q59: Table 18-3 Q61: In 2010,which type of tax raised the Q102: Which of the following is an example Q107: The term "payroll taxes" is often used Q114: A regressive tax is a tax for Q119: In the United States, over the past Q124: The marginal tax rate is Q125: The average tax rate is calculated as Q135: When considering changes in tax policy, economists

![]()

![]()

A)the amount of

A)total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents