You are serving as the trustee for the Paul Porter testamentary income trust.The trust was created by Paul's will.All of his assets were transferred to the trust to cover the living expenses of his wife, Paula.Upon her death, the assets are to be sold, with the proceeds distributed to his brother, Saul.If Saul is not alive when Paula passes, the proceeds are to go to the Porter Scholarship in Business Administration.

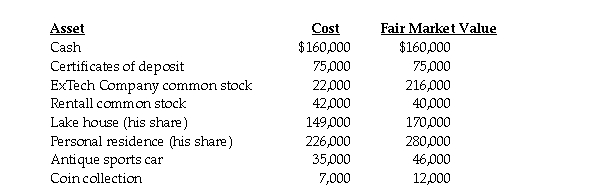

The probate court has ruled that all personal effects and household items could be excluded from the estate.All taxes have been paid, and the following assets remain to be transferred to the trust:

Required:

Required:

Prepare the journal entries for the creation of the trust.

Correct Answer:

Verified

Q1: In reference to the potential taxation of

Q11: In reference to the probate process,which of

Q12: Under the amended Uniform Probate Code,if the

Q13: Under the Uniform Probate Code,the term "personal

Q22: Warren Peace passed away,with his will leaving

Q25: Rusty Nail died in the summer of

Q25: Mason Dixon dies on November 30, 2011,

Q26: Josh Drake died on May 1, 2011.He

Q34: Oscar Lloyd is serving as the executor

Q35: Oscar Lloyd is the trustee for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents