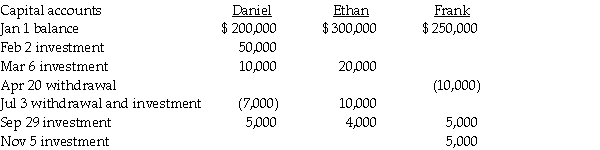

Daniel, Ethan, and Frank have a retail partnership business selling personal computers.The partners are allowed an interest allocation of 8% on their average capital.Capital account balances on the first day of each month are used in determining weighted average capital, regardless of additional partner investment or withdrawal transactions during any given month.Withdrawals of capital that are debited to the capital account are used in the average calculation.Partner capital activity for the year was:

Required:

Required:

Calculate weighted average capital for each partner, and determine the amount of interest that each partner will be allocated.Round all calculations to the nearest whole dollar.

Correct Answer:

Verified

Q22: On February 1,2011,George,Hamm,and Ishmael began a partnership

Q24: Anna and Bess share partnership profits and

Q25: Use the following information to answer the

Q26: A summary balance sheet for the Uma,

Q28: The profit and loss sharing agreement for

Q31: A summary balance sheet for the Ash,

Q33: Use the following information to answer the

Q34: On July 1,2011,Joe,Kline,and Lama began a partnership

Q36: Use the following information to answer the

Q37: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents