On January 1, 2011, Pilgrim Corporation, a U.S.firm, acquired ownership of Settlement Corporation, a foreign company, for $168,000, when Settlement's stockholders' equity consisted of 300,000 local currency units (LCU)and retained earnings of 100,000 LCU.At the time of the acquisition, Settlement's assets and liabilities were fairly valued except for a patent that did not have any recorded book value.All excess purchase cost was attributed to the patent, which had an estimated economic life of 10 years at the date of acquisition.The exchange rate for LCUs on January 1, 2011 was $.40.The functional currency for Settlement is LCU.Settlement's books are maintained in LCU.

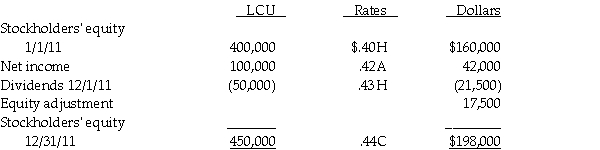

A summary of changes in Settlement's stockholders' equity during 2011 and the exchange rates for LCUs is as follows:

Required: Determine the following:

Required: Determine the following:

1.Fair value of the patent from Pilgrim's investment in Settlement on January 1, 2011 in U.S.dollars.

2.Patent amortization for 2011 in U.S.dollars.

3.Unamortized patent at December 31, 2011 in U.S.dollars.

4.Equity adjustment from the patent in U.S.dollars.

5.Income from Settlement for 2011 in U.S.dollars.

6.Investment in Settlement balance at December 31, 2011 in U.S.dollars.

Correct Answer:

Verified

Q28: Pan Corporation, a U.S.company, formed a British

Q29: Each of the following accounts has been

Q30: For each of the 12 accounts listed

Q31: Plato Corporation, a U.S.company, purchases all of

Q32: Plane Corporation, a U.S.company, owns 100% of

Q34: On January 1, 2011, Placid Corporation acquired

Q35: On January 1, 2011, Paste Unlimited, a

Q36: On January 1, 2011, Psalm Corporation purchased

Q37: Par Industries, a U.S.Corporation, purchased Slice Company

Q38: Plate Corporation, a US company, acquired ownership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents