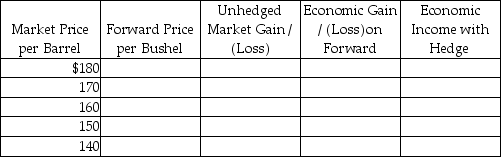

In September of 2011, Gunny Corporation anticipates that the price of heating oil will increase soon, and wishes to lock in a firm price for the winter months.They enter into a forward contract with Selton Industries to buy 100,000 barrels of oil at $160 per barrel in December 2011.Selton's cost of production of the heating oil is $120 per barrel.

Required:

Determine the economic impact of the transaction to Selton (the seller of the heating oil)at the market price levels indicated in the table below, with and without the hedge.

Correct Answer:

Verified

Q23: On October 15,2011,Napole Corporation,a French company,ordered merchandise

Q24: Behd Company, a U.S.firm, sold some of

Q27: A review of Ace Industries, a U.S.corporation,

Q29: Jefferson Company entered into a forward contract

Q31: On April 1,2012,Button Industries enters into an

Q31: Piel Corporation (a U.S.company)began operations on January

Q32: Meric Corporation (a U.S.company)began operations on January

Q33: Plymouth Corporation (a U.S.company)began operations on September

Q34: Johnson Corporation (a U.S.company)began operations on December

Q35: Crabby Industries,a U.S.corporation,purchased inventory from a company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents