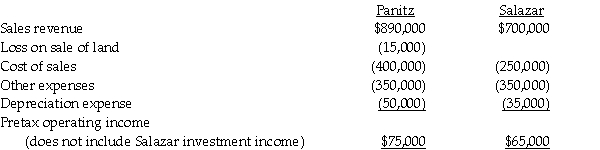

Pretax operating incomes of Panitz Corporation and its 80%-owned subsidiary, Salazar Corporation, for the year 2011, are shown below.

Panitz and Salazar belong to an affiliated group.Salazar pays total dividends of $35,000 for the year.There are no unamortized book value/fair value differentials relating to Panitz's investment in Salazar.During the year, Panitz sold land to Salazar at a total loss of $15,000 which is included in its pretax operating income.Salazar still holds this land at the end of the year.The marginal corporate tax rate for both corporations is 34%.

Required:

Required:

1.Determine the separate amounts of income tax expense for Panitz and Salazar as if they had filed separate tax returns.

2.Determine Panitz's net income from Salazar.

Correct Answer:

Verified

Q1: Pan Corporation has total stockholders' equity of

Q6: Parnaby has 25,000 common stock shares outstanding

Q9: If a parent company has controlling interest

Q20: What should be the noncontrolling interest share,preferred

Q21: Saito Corporation's stockholders' equity on December 31,

Q23: Pane Corporation owns 100% of Alder Corporation,

Q25: Samford Corporation's stockholders' equity on December 31,

Q26: Sandy Corporation's stockholders' equity on December 31,

Q27: Sally Corporation's stockholders' equity on December 31,

Q30: Pandy Corporation owns a 90% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents