Pacini Corporation owns an 80% interest in Abdoo Corporation, acquired on January 1, 2010 for $700,000 when Abdoo's stockholders' equity consisted of $600,000 of Capital Stock and $200,000 of Retained Earnings.

Abdoo Corporation acquired a 60% interest in Bach Corporation on July 1, 2010 for $180,000 when Bach had Capital Stock of $200,000 and Retained Earnings of $50,000.On January 1, 2011, Abdoo acquired a 70% interest in Cabo Corporation for $270,000 when Cabo had Capital Stock of $250,000 and Retained Earnings of $100,000.

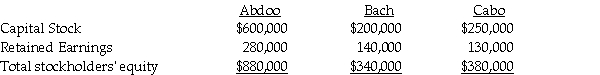

No change in outstanding stock of any of the affiliated companies has occurred since the investments were made.All cost-book value differentials are goodwill.There are no fair value/book value differentials.The stockholders' equity section of the separate balance sheets of Abdoo, Bach, and Cabo at December 31, 2011 are as follows:

Required:

Required:

1.Compute the amount at which goodwill should be shown in the consolidated balance sheet of Pacini Corporation and Subsidiaries at December 31, 2011.

2.Pacini and Abdoo have applied the equity method correctly.Determine the balances of the three investment accounts at December 31, 2011.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Packer Corporation owns 100% of Abel Corporation,Abel

Q27: On January 1, 2011 Paki Inc.bought 75%

Q28: On January 1, 2011, Klode Corporation acquired

Q28: Paik Corporation owns 80% of Acdol Corporation

Q29: Separate earnings and investment percentages for three

Q32: Paice Corporation owns 80% of the voting

Q33: Paine Corporation owns 90% of Achan Corporation,Achan

Q33: Padhy Corporation owns 80% of Abrams Corporation,Abrams

Q37: On January 1, 2011, Wrobel Company acquired

Q40: Paco Corporation owns 90% of Aber Corporation,Aber

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents