Palmer Corporation purchased 75% of Stone Industries' common stock on January 2, 2010.On January 1, 2011, Stone sold equipment to Palmer that had a net book value of $16,000 and an original cost of $24,000 for $20,000.On January 1, 2011, Palmer sold a building to Stone that had a net book value of $200,000 and an original cost of $250,000 for $300,000.The equipment had a remaining useful life of 8 years, and the building had a remaining useful life of 20 years.Neither asset had salvage value.Both companies use straight-line depreciation.

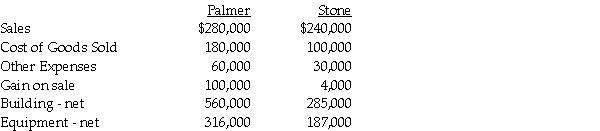

Selected account balances are shown below for Palmer and Stone for the year ended December 31, 2011:

Required:

Required:

1.Prepare the consolidating working paper entries relating to the equipment and building for the year ended December 31, 2011.

2.Calculate the following balances for the year ended December 31, 2011:

A.Consolidated "Other Expenses"

B.Consolidated Buildings

C.Consolidated Equipment

D.Noncontrolling interest in Stone's net income

Correct Answer:

Verified

A.Consolidated Other Expe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Several years ago,Pilot International purchased 70% of

Q24: On January 2,2012,Pal Corporation sold warehouse equipment

Q25: Snow Company is a wholly owned subsidiary

Q30: Separate income statements of Pingair Corporation and

Q33: Plower Corporation acquired all of the outstanding

Q33: Plock Corporation,the 75% owner of Seraphim Company,reported

Q34: Porter Corporation acquired 70% of the outstanding

Q35: Prey Corporation created a wholly owned subsidiary,

Q36: Passo Corporation acquired a 70% interest in

Q38: Paula's Pizzas purchased 80% of their supplier,Sarah's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents