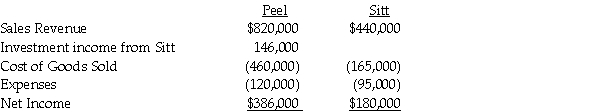

Peel Corporation acquired a 80% interest in Sitt Corporation at a cost equal to 80% of the book value of Sitt several years ago.At the time of purchase, the fair value and book value of Sitt's assets and liabilities were equal.Sitt purchases its entire inventory from Peel at 150% of Peel's cost.During 2011, Peel sold $190,000 of merchandise to Sitt.Sitt's beginning and ending inventories for 2011 were $72,000 and $66,000, respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Peel Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Q24: Psalm Enterprises owns 90% of the outstanding

Q30: Pfeifer Corporation acquired an 80% interest in

Q32: Paulee Corporation paid $24,800 for an 80%

Q33: On January 1, 2011, Paar Incorporated paid

Q34: Preen Corporation acquired a 60% interest in

Q35: PreBuild Manufacturing acquired 100% of Shoding Industries

Q35: Pirate Transport bought 80% of the outstanding

Q37: Pexo Industries purchases the majority of their

Q38: Penguin Corporation acquired a 60% interest in

Q39: Plover Corporation acquired 80% of Sink Inc.equity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents