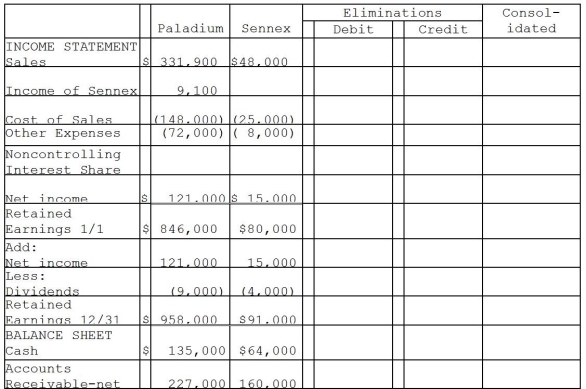

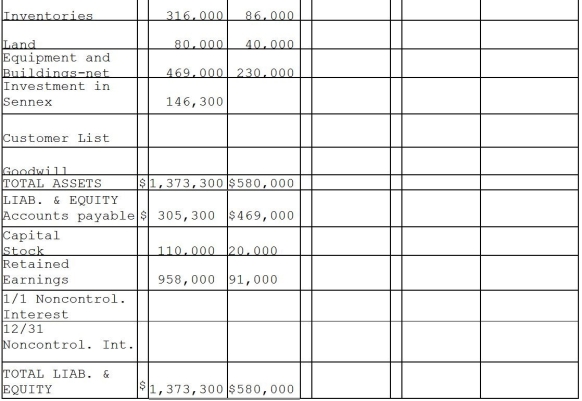

On December 31, 2011, Paladium International purchased 70% of the outstanding common stock of Sennex Chemical.Paladium paid $140,000 for the shares and determined that the fair value of all recorded Sennex assets and liabilities approximated their book values, with the exception of a customer list that was not recorded and had a fair value of $10,000, and an expected remaining useful life of 5 years.At the time of purchase, Sennex had stockholders' equity consisting of capital stock amounting to $20,000 and retained earnings amounting to $80,000.Any remaining excess fair value was attributed to goodwill.The separate financial statements at December 31, 2012 appear in the first two columns of the consolidation workpapers shown below.

Required:

Complete the consolidation working papers for Paladium and Sennex for the year 2012.

Paladium

Correct Answer:

Verified

Q28: Flagship Company has the following information collected

Q29: Parrot Corporation acquired 90% of Swallow Co.on

Q30: Pawl Corporation acquired 90% of Snab Corporation

Q31: Platt Corporation paid $87,500 for a 70%

Q32: On January 1, 2011, Persona Company acquired

Q34: Pennack Corporation purchased 75% of the outstanding

Q35: Pecan Incorporated acquired 80% of the voting

Q36: Puddle Corporation acquired all the voting stock

Q37: On January 2, 2011, Paleon Packaging purchased

Q38: On January 1, 2011, Paisley Incorporated paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents