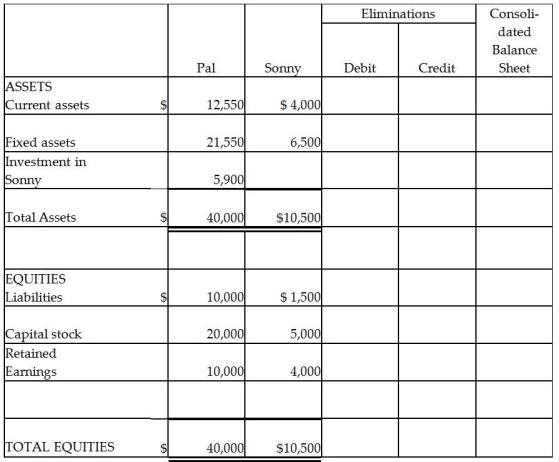

Pal Corporation paid $5,000 for a 60% interest in Sonny Inc.on January 1, 2011 when Sonny's stockholders' equity consisted of $5,000 Capital Stock and $2,500 Retained Earnings.The fair value and book value of Sonny's assets and liabilities were equal on this date.Two years later, on December 31, 2012, the balance sheets of Pal and Sonny are summarized as follows:

Required:

Required:

Complete the consolidated balance sheet working papers for Pal Corporation and Subsidiary at December 31, 2012.

Correct Answer:

Verified

Q2: Push-down accounting

A)requires a subsidiary to use the

Q6: Pomograte Corporation bought 75% of Sycamore Company's

Q14: In the consolidated income statement of Wattlebird

Q16: Perth Corporation acquired a 100% interest in

Q17: What method must be used if FASB

Q22: Passerby International purchased 80% of Standaround Company's

Q23: Parrot Inc.acquired an 85% interest in Sparrow

Q24: Pamula Corporation paid $279,000 for 90% of

Q25: On July 1, 2011, Piper Corporation issued

Q26: Pool Industries paid $540,000 to purchase 75%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents