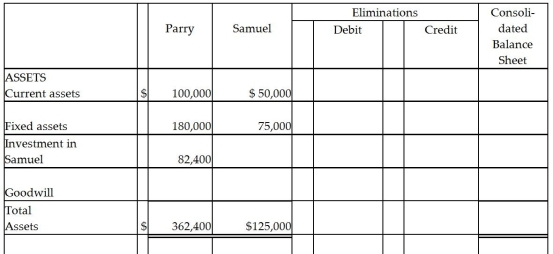

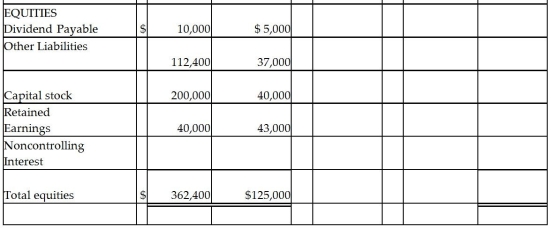

On January 1, 2011, Parry Incorporated paid $72,000 cash for 80% of Samuel Company's common stock.At that time Samuel had $40,000 capital stock and $30,000 retained earnings.The book values of Samuel's assets and liabilities were equal to fair values, and any excess amount is allocated to goodwill.Samuel reported net income of $18,000 during 2011 and declared $5,000 of dividends on December 31, 2011.At the time the dividends were declared, Parry recorded a receivable for the amount they expected to receive the following month.A summary of the balance sheets of Parry and Samuel are shown below.

Required:

Required:

Complete the consolidated balance sheet working papers for Parry Corporation and Subsidiary at December 31, 2011.

Correct Answer:

Verified

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q28: On January 1, 2005, Myna Corporation issued

Q29: Petra Corporation paid $500,000 for 80% of

Q30: The consolidated balance sheet of Pasker Corporation

Q31: Passcode Incorporated acquired 90% of Safe Systems

Q32: On January 1, 2011, Pinnead Incorporated paid

Q34: Polaris Incorporated purchased 80% of The Solar

Q35: Park Corporation paid $180,000 for a 75%

Q36: On January 2, 2011, Power Incorporated paid

Q38: Pool Industries paid $540,000 to purchase 75%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents