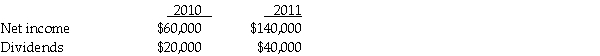

Pike Corporation paid $100,000 for a 10% interest in Salmon Corp.on January 1, 2010, when Salmon's stockholders' equity consisted of $800,000 of $10 par value common stock and $200,000 retained earnings.On December 31, 2011, after receipt of the year's dividends from Salmon, Pike paid $192,000 for an additional 20% interest in Salmon Corp.Both of Pike's investments were made when Salmon's book values equaled their fair values.Salmon's net income and dividends for 2010 and 2011 were as follows:

Required:

Required:

1.Prepare journal entries for Pike Corporation to account for its investment in Salmon Corporation for 2010 and 2011.

2.Calculate the balance of Pike's investment in Salmon at December 31, 2011

Correct Answer:

Verified

Q11: Use the following information to answer the

Q18: The income from an equity method investee

Q22: Plum Corporation paid $700,000 for a 40%

Q23: On January 1, 2010, Petrel, Inc.purchased 70%

Q26: Paster Corporation was seeking to expand its

Q28: On January 1, 2010, Platt Corporation purchased

Q29: On January 2,2010,Slurg Corporation paid $600,000 to

Q29: On January 1, 2010, Palgan, Co.purchased 75%

Q32: Shebing Corporation had $80,000 of $10 par

Q34: Shoreline Corporation had $3,000,000 of $10 par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents