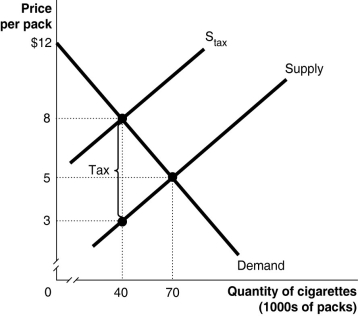

Figure 4-9  Figure 4-9 shows the market for cigarettes.The government plans to impose a per-unit tax in this market.

Figure 4-9 shows the market for cigarettes.The government plans to impose a per-unit tax in this market.

-Refer to Figure 4-9.As a result of the tax,is there a loss in producer surplus?

A) Yes,because producers are not selling as many units now.

B) No,because the consumer pays the tax.

C) No,because the market reaches a new equilibrium

D) No,because producers are able to raise the price to cover their tax burden.

Correct Answer:

Verified

Q170: The government proposes a tax on halogen

Q171: Using a supply and demand graph,illustrate the

Q172: Figure 4-9 Q173: Tax incidence is the actual division of Q174: Figure 4-7 Q176: Figure 4-9 Q177: Suppose the demand curve for a product Q178: Suppose an excise tax of $0.75 is Q179: Figure 4-11 Q180: FICA is a payroll tax imposed on Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()