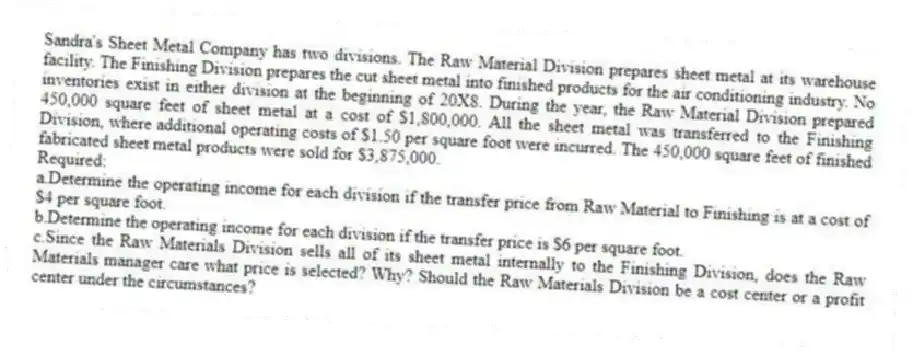

Sandra's Sheet Metal Company has two divisions. The Raw Material Division prepares sheet metal at its warehouse facility. The Finishing Division prepares the cut sheet metal into finished products for the air conditioning industry. No inventories exist in either division at the beginning of 20X8. During the year, the Raw Material Division prepared 450,000 square feet of sheet metal at a cost of $1,800,000. All the sheet metal was transferred to the Finishing Division, where additional operating costs of $1.50 per square foot were incurred. The 450,000 square feet of finished fabricated sheet metal products were sold for $3,875,000.

Required:

a.Determine the operating income for each division if the transfer price from Raw Material to Finishing is at a cost of $4 per square foot.

b.Determine the operating income for each division if the transfer price is $6 per square foot.

c.Since the Raw Materials Division sells all of its sheet metal internally to the Finishing Division, does the Raw Materials manager care what price is selected? Why? Should the Raw Materials Division be a cost center or a profit center under the circumstances?

Correct Answer:

Verified

* 450,000 square feet × $4 = $1,80...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Transferring products internally at a market price

Q93: Bedtime Bedding Company manufactures pillows. The Cover

Q94: DesMoines Valley Company has two divisions, Computer

Q95: When companies do not want to use

Q96: A perfectly competitive market exists when which

Q98: When an industry has excess capacity, market

Q99: Olive Branch Company recently acquired an olive

Q100: Briefly explain each of the three methods

Q101: A company should use cost-based transfer prices

Q102: Nig Car Company manufactures automobiles. The Fastback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents