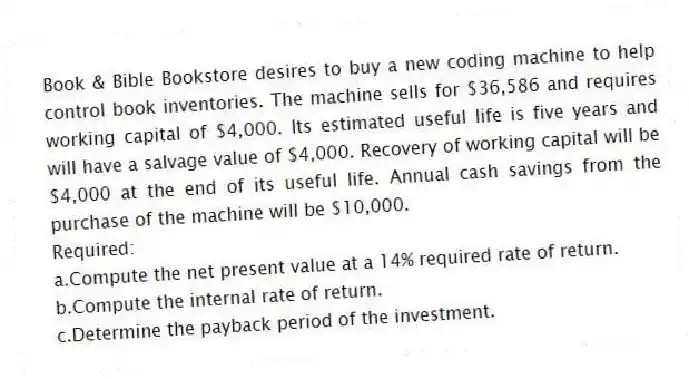

Book & Bible Bookstore desires to buy a new coding machine to help control book inventories. The machine sells for $36,586 and requires working capital of $4,000. Its estimated useful life is five years and will have a salvage value of $4,000. Recovery of working capital will be $4,000 at the end of its useful life. Annual cash savings from the purchase of the machine will be $10,000.

Required:

a.Compute the net present value at a 14% required rate of return.

b.Compute the internal rate of return.

c.Determine the payback period of the investment.

Correct Answer:

Verified

b.Trial and error is required. Bec...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Which of the following statements is true

Q93: Cedile Trailer Supply has received three proposals

Q94: Pearl Manufacturing Company provides glassware machines for

Q95: Which of the following is the numerator

Q96: A weaknesses of the payback method is

Q98: Sam's Structures desires to buy a new

Q99: Accrual accounting rate of return is calculated

Q100: Unlike the payback method, which ignores cash

Q101: The Venoid Corporation has an annual cash

Q102: The accrual accounting rate-of-return method has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents