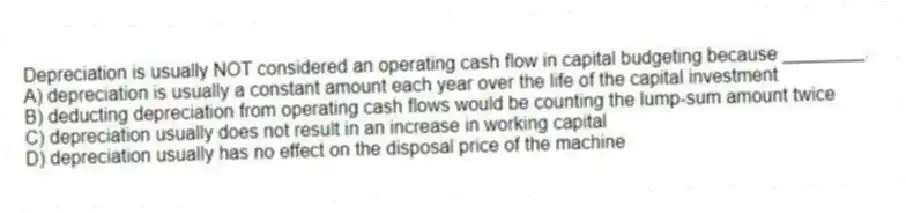

Depreciation is usually NOT considered an operating cash flow in capital budgeting because ________.

A) depreciation is usually a constant amount each year over the life of the capital investment

B) deducting depreciation from operating cash flows would be counting the lump-sum amount twice

C) depreciation usually does not result in an increase in working capital

D) depreciation usually has no effect on the disposal price of the machine

Correct Answer:

Verified

Q104: The Ambitz Corporation has an annual cash

Q105: As cash flows and time value of

Q106: Which of the following is a component

Q107: The focus in capital budgeting should be

Q108: The galaxy Corporation disposes a capital asset

Q110: Gibson Manufacturing is considering buying an automated

Q111: An example of a sunk cost in

Q112: Bock Construction Company is considering four proposals

Q113: The relevant terminal disposal price of a

Q114: Gavin and Alex, baseball consultants, are in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents