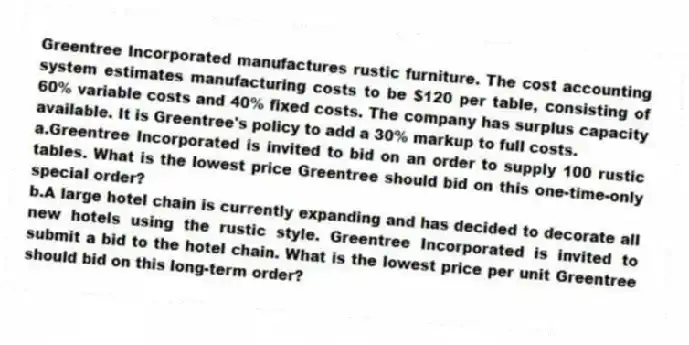

Greentree Incorporated manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $120 per table, consisting of 60% variable costs and 40% fixed costs. The company has surplus capacity available. It is Greentree's policy to add a 30% markup to full costs.

a.Greentree Incorporated is invited to bid on an order to supply 100 rustic tables. What is the lowest price Greentree should bid on this one-time-only special order?

b.A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Greentree Incorporated is invited to submit a bid to the hotel chain. What is the lowest price per unit Greentree should bid on this long-term order?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: In long-run pricing, decisions should consider all

Q44: Which of the following is true of

Q45: Companies operating in competitive markets generally use

Q46: One purpose of cost allocations is to

Q47: Companies operating in competitive markets should ideally

Q49: Explain the differences between short-run pricing decisions

Q50: Cost allocation is not required to cost

Q51: Quick Connect manufactures high-tech cell phones. Quick

Q52: Which of the following explains the cost-plus

Q53: Short-run prices should at least recover _.

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents