On July 1, 2012, Bobby's Building Corp. issued $1,000,000 of 10% bonds dated July 1, 2012 for $937,229. The bonds were sold to yield 11% and pay interest semiannually on June 31 and December 31. Bobby's Building Corp. uses the effective interest method of amortization.

Required (Round all amounts to the nearest dollar):

1. Prepare the journal entry to record the issuance of the bonds on July 1, 2012.

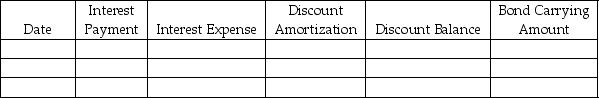

2. Complete the amortization table below for the first two interest periods.

3. Prepare the journal entry to record the interest payment on December 31, 2012.

3. Prepare the journal entry to record the interest payment on December 31, 2012.

4. Suppose Bobby's Building Corp. has a fiscal year end of February 28. Prepare any adjusting entry needed on February 28, 2012.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: The times-interest-earned ratio is calculated by dividing

Q154: Earnings per share is a standard measure

Q171: On April 1, 2012, Edward Company issues

Q172: On January 1, 2012, Kensington Valley Company

Q173: Immediately after the last interest payment, Henderson

Q174: On January 1, 2012, Henderson Company issued

Q175: On January 1, 2012, Fisher Corporation issued

Q178: Wolverines, Inc. issued $1,000,000 of 7.5%, 10-year

Q180: On January 1, Potter Company issued $600,000,

Q181: The debt to total assets ratio is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents