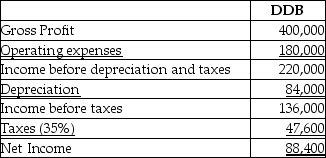

Martin Motors purchased a machine that will help diagnose problems with engines. The machine cost $210,000 on January 10, 2010 and a residual value of $10,000 was anticipated, with a useful life of 5 years. These statistics are available:

Martin Motors realized at the beginning of 2012 that the machine would last an additional 8 years. Martin Motors uses the DDB method.

Martin Motors realized at the beginning of 2012 that the machine would last an additional 8 years. Martin Motors uses the DDB method.

Prepare the appropriate journal entry to record the depreciation expense for 2012.

Correct Answer:

Verified

Q112: To account for the disposal of a

Q116: On January 2, 2011, KJ Corporation acquired

Q117: On January 2, 2011, KJ Corporation acquired

Q118: On January 2, 2012, Mummy Corporation acquired

Q119: Buggy Company purchased equipment on June 3,

Q120: On January 2, 2011, KJ Corporation acquired

Q122: Marsha Cook owns Marsha's Pie Co. On

Q123: If an asset is sold:

A) depreciation must

Q124: On January 3, 2011, Hank's Excavating Company

Q125: Which of the following is a correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents