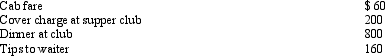

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

A) $1,220.

B) $740.

C) $640.

D) $610.

E) None of the above.

Correct Answer:

Verified

Q81: In which, if any, of the following

Q84: During the year,Peggy went from Nashville to

Q85: During the year,Oscar travels from Raleigh to

Q86: Michael is the city sales manager for

Q86: Bill is the regional manager for a

Q87: Due to a merger,Allison transfers from Miami

Q90: The § 222 deduction for tuition and

Q91: In terms of meeting the distance test

Q91: Amy works as an auditor for a

Q98: The § 222 deduction for tuition and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents