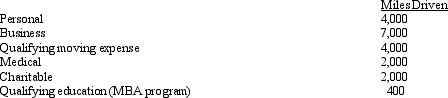

Clint uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2011,his mileage was as follows:

How much can Clint claim for mileage?

How much can Clint claim for mileage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Myra's classification of those who work for

Q110: Jacob is a landscape architect who works

Q125: In terms of income tax treatment, what

Q129: In the current year,Bo accepted employment with

Q132: Alfredo,a self-employed patent attorney,flew from his home

Q133: Nicole moved from California to Dallas to

Q135: Rocky has a full-time job as an

Q136: For the current football season,Rust Corporation pays

Q137: Under the automatic mileage method,one rate does

Q139: Samuel,age 53,has a traditional deductible IRA with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents