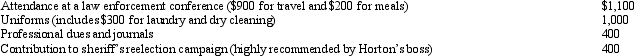

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Jacob is a landscape architect who works

Q115: Elsie lives and works in Detroit. She

Q123: If a business retains someone to provide

Q125: Evan is employed as an assistant manager

Q125: In terms of income tax treatment, what

Q126: Cathy takes five key clients to a

Q127: Taylor performs services for Jonathan on a

Q129: In the current year,Bo accepted employment with

Q132: Alfredo,a self-employed patent attorney,flew from his home

Q133: Nicole moved from California to Dallas to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents