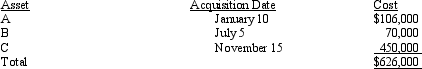

Audra acquires the following new five-year class property in 2011:

Audra elects § 179 for Asset B and Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra elects not to take additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Audra elects § 179 for Asset B and Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra elects not to take additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Augie purchased one used asset during the

Q80: White Company acquires a new machine (seven-year

Q81: On March 3,2011,Sally purchased and placed in

Q82: Polly purchased a new hotel on July

Q83: On April 5,2011,Orange Corporation purchased,and placed in

Q85: On June 1,2011,Red Corporation purchased an existing

Q86: George purchases used seven-year class property at

Q87: On February 15,2011,Martin signed a 20-year lease

Q88: Sid bought a new $700,000 seven-year class

Q89: On January 15,2011,Vern purchased the rights to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents