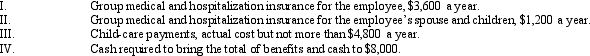

Under the Swan Company's cafeteria plan,all full-time employees are allowed to select any combination of the benefits below,but the total received by the employee cannot exceed $8,000 a year.  Which of the following statements is true?

Which of the following statements is true?

A) Sam, a full-time employee, selects choices II and III and $2,000 cash. His gross income must include the $2,000.

B) Paul, a full-time employee, elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him. Paul is required to include the $8,000 in gross income.

C) Sue, a full-time employee, elects to receive choices I, II and $3,200 for III. Sue is not required to include any of the above in gross income.

D) All of the above.

E) None of the above.

Correct Answer:

Verified

Q69: The Royal Motor Company manufactures automobiles.Employees of

Q70: Section 119 excludes the value of meals

Q74: Peggy is an executive for the Tan

Q75: A U.S.citizen worked in a foreign country

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents