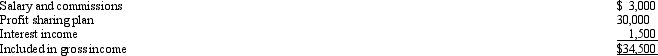

Beverly died during the current year.At the time of her death,her accrued salary and commissions totaled $3,000 and were paid to her husband.The employer also paid the husband $35,000 which represented an amount equal to Beverly's salary for the year prior to her death.The employer had a policy of making the salary payments to "help out the family in the time of its greatest need." Beverly's spouse collected her interest in the employer's qualified profit sharing plan amounting to $30,000.As beneficiary of his wife's life insurance policy,Beverly's spouse elected to collect the proceeds in installments.In the year of death,he collected $8,000 which included $1,500 interest income.Which of these items are subject to income tax for Beverly's spouse?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Tonya is a cash basis taxpayer.In 2011,she

Q83: George,an unmarried cash basis taxpayer,received the following

Q84: Heather's interest and gains on investments for

Q85: Gold Company was experiencing financial difficulties, but

Q85: Flora Company owed $95,000 to the National

Q88: In the case of interest income from

Q89: Louise works in a foreign branch of

Q91: Hazel, a solvent individual but a recovering

Q93: The exclusion of interest on educational savings

Q97: Stuart owns 300 shares of Turquoise Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents