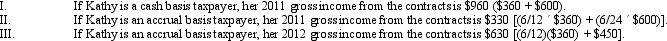

Kathy operates a gym.She sells memberships that entitle the member to use the facilities at any time.A one-year membership costs $360 ($360/12 = $30 per month) ; a two-year membership costs $600 ($600/24 = $25 per month) .Cash payment is required at the beginning of the membership period.On July 1,2011,Kathy sold a one-year membership and a two-year membership.

A) Only I is true.

B) Only I and II are true.

C) Only II and III are true.

D) I, II, and III are true.

E) None of the above.

Correct Answer:

Verified

Q63: With respect to the prepaid income from

Q67: The underlying rationale for the alimony rules

Q71: Theresa,a cash basis taxpayer,purchased a bond on

Q74: As a general rule: Q74: Mike contracted with Kram Company, Mike's controlled Q75: Jim and Nora,residents of a community property Q76: Harry and Wanda were married in Texas, Q77: Wayne owns a 25% interest in the Q79: On October 1,2011,Bob,a cash basis taxpayer,gave Dave Q81: Jay,a single taxpayer,retired from his job as![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents