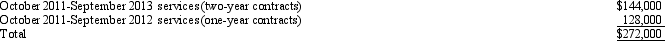

Orange Cable TV Company,an accrual basis taxpayer,allows its customers to pay by the year in advance ($500 per year) ,or two years in advance ($950) .In September 2011,the company collected the following amounts applicable to future services:  As a result of the above,Orange Cable should report as gross income:

As a result of the above,Orange Cable should report as gross income:

A) $272,000 in 2011.

B) $128,000 in 2011.

C) $168,000 in 2012.

D) $222,000 in 2012.

E) None of the above.

Correct Answer:

Verified

Q63: With respect to the prepaid income from

Q64: On January 5,2011,Jane purchased a bond paying

Q65: With respect to income from services,which of

Q66: Freddy purchased a certificate of deposit for

Q67: Teal company is an accrual basis taxpayer.On

Q68: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q70: Office Palace,Inc.,leased an all-in-one printer to a

Q71: Theresa,a cash basis taxpayer,purchased a bond on

Q74: Mike contracted with Kram Company, Mike's controlled

Q74: As a general rule: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents