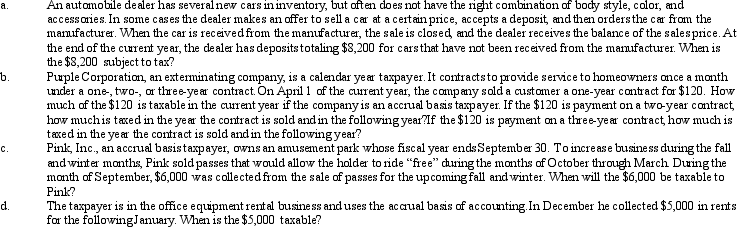

Determine the proper tax year for gross income inclusion in each of the following cases.

Correct Answer:

Verified

Q101: Melissa is a compulsive coupon clipper. She

Q103: Ted paid $73,600 to receive $10,000 at

Q103: Turner, Inc., provides group term life insurance

Q105: Katherine is 60 years old and is

Q110: Margaret owns land that appreciates at the

Q112: The amount of Social Security benefits received

Q112: Ted was shopping for a new automobile.

Q114: On January 1,2011,Faye gave Todd,her son,a 36-month

Q115: In some foreign countries, the tax law

Q119: Debbie is age 67 and unmarried and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents