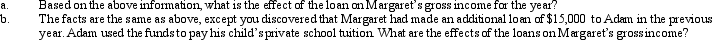

Margaret made a $90,000 interest-free loan to her son,Adam,who used the money to retire a mortgage on his personal residence and to buy a certificate of deposit.Adam's only income for the year is his salary of $35,000 and $1,400 interest income on the certificate of deposit.The relevant Federal interest rate is 8% compounded semiannually.The loan is outstanding for the entire year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Turner, Inc., provides group term life insurance

Q104: The taxable portion of Social Security benefits

Q106: Roy is considering purchasing land for $10,000.He

Q113: Rachel, who is in the 35% marginal

Q117: In the case of a zero interest

Q118: In January 2011,Tammy purchased a bond due

Q119: Sarah,a widow,is retired and receives $24,000 interest

Q122: Under the formula for taxing Social Security

Q123: Rachel owns rental properties. When Rachel rents

Q124: Dick and Jane are divorced in 2010.At

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents