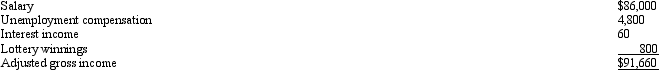

Arnold was employed during the first six months of the year and earned a $86,000 salary.During the next 6 months,he collected $4,800 of unemployment compensation,borrowed $6,000 (using his personal residence as collateral),and withdrew $1,000 from his savings account (including $60,interest).His luck was not all bad,for in December he won $800 in the lottery on a $20 ticket.Because of his dire circumstances,Arnold's parents loaned him $10,000 (interest-free)on July 1 of the current year,when the Federal rate was 8%.Arnold did not repay the loan during the year and used the money for living expenses.Calculate Arnold's adjusted gross income for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Tim and Janet were divorced.Their only marital

Q95: Which of the following is not a

Q101: José,a cash method taxpayer,is a partner in

Q101: Melissa is a compulsive coupon clipper. She

Q103: Ted paid $73,600 to receive $10,000 at

Q105: Katherine is 60 years old and is

Q108: Ted and Alice were in the process

Q110: Margaret owns land that appreciates at the

Q117: Our tax laws encourage taxpayers to _

Q119: Debbie is age 67 and unmarried and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents