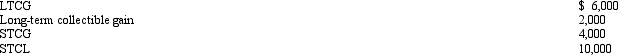

During 2011,Trevor has the following capital transactions:  After the netting process,the following results:

After the netting process,the following results:

A) Long-term collectible gain of $2,000.

B) LTCG of $6,000, Long-term collectible gain of $2,000, and a STCL of $6,000.

C) LTCG of $6,000, Long-term collectible gain of $2,000, and a STCL carryover to 2012 of $3,000.

D) LTCG of $2,000.

E) None of the above.

Correct Answer:

Verified

Q77: During 2011,Marvin had the following transactions:

Q78: Which of the following items,if any,is deductible?

A)Parking

Q78: Tony,age 15,is claimed as a dependent by

Q80: Kyle and Liza are married and under

Q81: Emily,whose husband died in December 2010,maintains a

Q84: For the qualifying relative rule (for dependency

Q84: Nelda is married to Chad,who abandoned her

Q86: In which,if any,of the following situations may

Q87: In which,if any,of the following situations will

Q97: A qualifying child cannot include:

A)A nonresident alien.

B)A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents