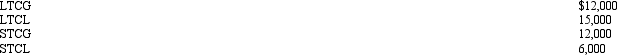

During 2011,Dena had salary income of $90,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Meg,age 23,is a full-time law student and

Q104: Bertha had the following transactions during 2011:

Q105: Ashley earns a salary of $35,000,has capital

Q106: During 2011,Lana has the following gains and

Q107: Bill had the following transactions for 2011:

Q109: Jim is single and for 2011 has

Q111: During 2011,Marcus had the following capital gains

Q112: Homer (age 68)and his wife Jean (age

Q113: During the year,Herb had the following transactions:

Q146: Mel is not quite sure whether an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents