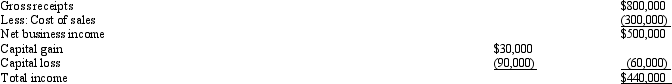

Jake,an individual calendar year taxpayer,incurred the following transactions.  Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

A) More than $110,000.

B) More than $132,500.

C) More than $207,500.

D) The six-year rule does not apply here.

Correct Answer:

Verified

Q54: The penalty for substantial understatement of tax

Q61: Concerning the penalty for civil tax fraud:

A)Fraudulent

Q67: Roger prepared for compensation a Federal income

Q68: Mickey, a calendar year taxpayer, was not

Q68: Vera is audited by the IRS for

Q76: The rules of Circular 230 need not

Q78: Concerning a taxpayer's requirement to make quarterly

Q79: The usual three-year statute of limitations on

Q86: Megan prepared for compensation a Federal income

Q96: The Statements on Standards for Tax Services

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents