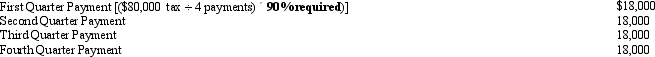

Carrie's AGI last year was $180,000.Her Federal income tax came to $60,000,which she paid through a combination of withholding and estimated payments.This year,her AGI will be $250,000,with a projected tax liability of $80,000,all to be paid through estimates.Ignore the annualized income method.Compute Carrie's quarterly estimated payment schedule for this year.

Current-Year Method

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Certain individuals are more likely than others

Q124: Arnold made a charitable contribution of property

Q132: Leo underpaid his taxes by $250,000.Portions of

Q135: Describe the following written determinations that are

Q137: Yin-Li is the preparer of the Form

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q140: Bettie,a calendar year individual taxpayer,files her 2009

Q142: Does the tax preparer enjoy an "attorney-client

Q153: The Treasury issues "private letter rulings" and

Q164: In connection with the taxpayer penalty for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents