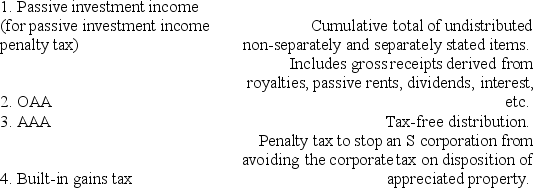

Match the term with the proper response.There may be more than one responses for each term.

Correct Answer:

Verified

Q104: Voting common stock and voting preferred stock

Q109: For Federal income tax purposes, taxation of

Q112: Separately stated items are listed on Schedule

Q116: An S corporation may have _ class(es)

Q117: Claude Bergeron sold 1,000 shares of Ditta,

Q119: A qualifying S election requires the consent

Q123: Post-termination distributions by a former S corporation

Q126: Since loss property receives a _ in

Q130: Non-separately computed loss _ a S shareholder's

Q140: Tax-exempt income is listed on Schedule _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents