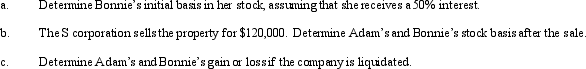

Individuals Adam and Bonnie form an S corporation,with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Correct Answer:

Verified

Q103: Stock basis first is increased by income

Q108: An S corporation's LIFO recapture amount equals

Q120: An S corporation's separately stated items generally

Q121: An S corporation recognizes a gain on

Q133: Realized gain is _ by an S

Q142: Gene Grams is a 45% owner of

Q142: Janet Wang is a 50% owner of

Q145: Simmen,Inc.,a calendar year S corporation,incurred the following

Q146: Bidden,Inc.,a calendar year S corporation,incurred the following

Q147: Explain how family members are treated for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents