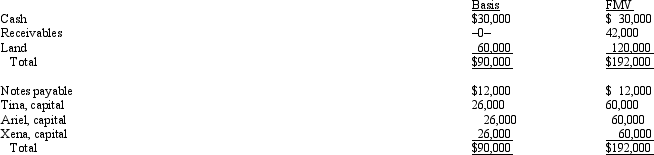

Tina sells her 1/3 interest in the TAX Partnership to James for $60,000 cash plus the assumption of Tina's $4,000 share of partnership debt.On the sale date,the partnership balance sheet and agreed-upon fair market values were as follows:  As a result of the sale,Tina recognizes:

As a result of the sale,Tina recognizes:

A) No gain or loss.

B) $34,000 capital gain.

C) $38,000 capital gain.

D) $14,000 ordinary income and $20,000 capital gain.

E) $14,000 capital gain and $24,000 ordinary income.

Correct Answer:

Verified

Q56: Jamie owns a 40% interest in the

Q64: In a proportionate liquidating distribution, Lina receives

Q74: In a proportionate liquidating distribution, Alexandria receives

Q127: Crystal contributes land to the newly formed

Q134: Match each of the following statements with

Q134: Which of the following statements correctly reflects

Q140: Greg and Justin are forming the GJ

Q167: In the current year, Derek formed an

Q212: Jonathon owns a one-third interest in a

Q233: Michelle receives a proportionate liquidating distribution when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents