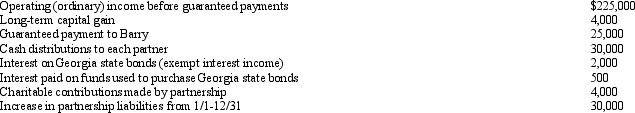

An examination of the RB Partnership's tax books provides the following information for the current year:

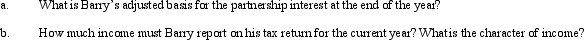

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

Correct Answer:

Verified

Q81: Cassandra is a 10% limited partner in

Q82: Allison and Taylor form a partnership by

Q87: Jamie contributed fully depreciated ($0 basis) property

Q99: Sharon and Sara are equal partners in

Q147: Katherine invested $80,000 this year to purchase

Q147: In the current year,the CAR Partnership received

Q148: The JIH Partnership distributed the following assets

Q149: Meagan is a 40% general partner in

Q150: Melissa is a partner in a continuing

Q154: James and Kendis created the JK Partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents