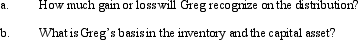

In a proportionate liquidating distribution in which the partnership is liquidated,Greg received cash of $20,000,inventory (basis of $2,000,fair market value of $3,000),and a capital asset (basis and fair market value of $4,000).Immediately before the distribution,Greg's basis in the partnership interest was $30,000.

Correct Answer:

Verified

Q56: Jamie owns a 40% interest in the

Q127: Crystal contributes land to the newly formed

Q140: Greg and Justin are forming the GJ

Q141: Harry and Sally are considering forming a

Q143: The MOP Partnership is involved in leasing

Q146: Chelsea owns a 25% capital and profits

Q147: In the current year,the CAR Partnership received

Q148: The JIH Partnership distributed the following assets

Q149: Meagan is a 40% general partner in

Q167: In the current year, Derek formed an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents