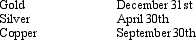

Gold Corporation,Silver Corporation,and Copper Corporation are equal partners in the GSC Partnership.The partners' tax year-ends are as follows:

A) The partnership is free to elect any tax year.

B) The partnership may use any of the 3 year-end dates that its partners use.

C) The partnership must use a September 30th year-end.

D) The partnership must use a April 30th year-end.

E) None of the above.

Correct Answer:

Verified

Q21: Which of the following statements regarding a

Q22: If an installment sale contract does not

Q25: Which of the following must use the

Q26: A cash basis taxpayer sold investment land

Q30: In 2011,Godfrey received a $50,000 sales commission

Q32: Andrew owns 100% of the stock of

Q32: When an accrual basis taxpayer finances the

Q34: Sandstone,Inc.,has consistently included some factory overhead as

Q36: In regard to choosing a tax year

Q37: In the case of a sale reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents