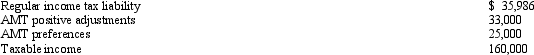

Miriam,who is a head of household and age 36,provides you with the following information from her financial records for 2011.  Calculate her AMTI for 2011.

Calculate her AMTI for 2011.

A) $0.

B) $171,300.

C) $195,925.

D) $218,000.

E) None of the above.

Correct Answer:

Verified

Q43: Brady's regular income tax liability is $300,000

Q46: The C corporation AMT rate can be

Q48: Corporations are subject to a positive AMT

Q49: As to the AMT,a C corporation has

Q51: For individual taxpayers, the AMT credit is

Q51: Applying the AMT rules,Lucinda has the following

Q51: For regular income tax purposes, Yolanda, who

Q53: Ashly is able to reduce her regular

Q59: The AMT does not apply to qualifying

Q60: Kay had percentage depletion of $119,000 for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents