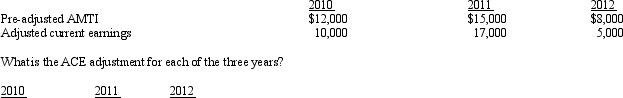

Mauve,Inc.,has the following for 2010,2011,and 2012 and no prior ACE adjustments.

A) $0 $1,500 ($1,500)

B) ($2,000) $2,000 ($3,000)

C) $2,000 ($2,000) $3,000

D) ($1,500) $1,500 $2,250

E) $1,500 ($1,500) ($2,250)

Correct Answer:

Verified

Q91: Why is there no AMT adjustment for

Q95: Cindy,who is single and has no dependents,has

Q95: How can the positive AMT adjustment for

Q96: Calico,Inc.,has AMTI of $305,000.Calculate the amount of

Q97: In May 2010,Egret,Inc.issues options to Andrea,a corporate

Q98: Sand Corporation,a calendar year taxpayer,has alternative minimum

Q99: Calculate the AMT exemption for 2011 if

Q101: Andrea,who is single,has a personal exemption deduction

Q104: If a taxpayer exercises an ISO and

Q104: Why is there a need for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents