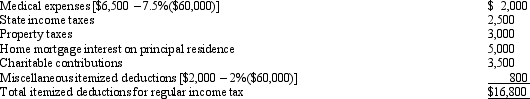

In calculating her taxable income,Rhonda deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: On January 3,1997,White Corporation acquired an office

Q76: Celia and Amos,who are married filing jointly,have

Q77: Which of the following can produce an

Q78: Omar acquires used 7-year personal property for

Q79: In 2011,Sean incurs $90,000 of mining exploration

Q82: Bianca and Barney have the following for

Q83: Lavender,Inc.,incurs research and experimental expenditures of $210,000

Q84: In 2011,Louise incurs circulation expenses of $210,000

Q85: Luke's itemized deductions in calculating taxable income

Q86: In September,Dorothy purchases a building for $900,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents